Empowering cash flow confidence

kwidflow harnesses the power of AI to help businesses get paid faster

Over 80% of businesses have experienced late payments in the past six months directly impacting their liquidity...

Over 80% of businesses have experienced late payments in the past six months directly impacting their liquidity...

kwidflow’s unique advantage

Faster liquidity advance using AI scoring and predictive analytics

1

supplier sells goods or services to buyer on extended payment terms

2

kwidflow engine scores upcoming transactions and buyer’s likelihood to pay

3

kwidflow offers supplier immediate payment as % of transaction value

4

buyer pays kwidflow full value on due date

When businesses struggle with cashflow they don’t have time to wait for credit

Traditional solutions use a lengthy process that is expensive and time-consuming

Creditworthiness

Only some customers may qualify for credit or invoice factoring and the process is not very transparent

Invoice Age

Longer payment terms are not included in traditional offers

Balance Sheet

Banks prefer to work with customers that have long histories and limited volatility

Industry

Invoice factoring doesn’t work for all sectors - so not everyone gets the same level of service

Payment History

Traditional credit services favour customers with consistent cashflow

How it works

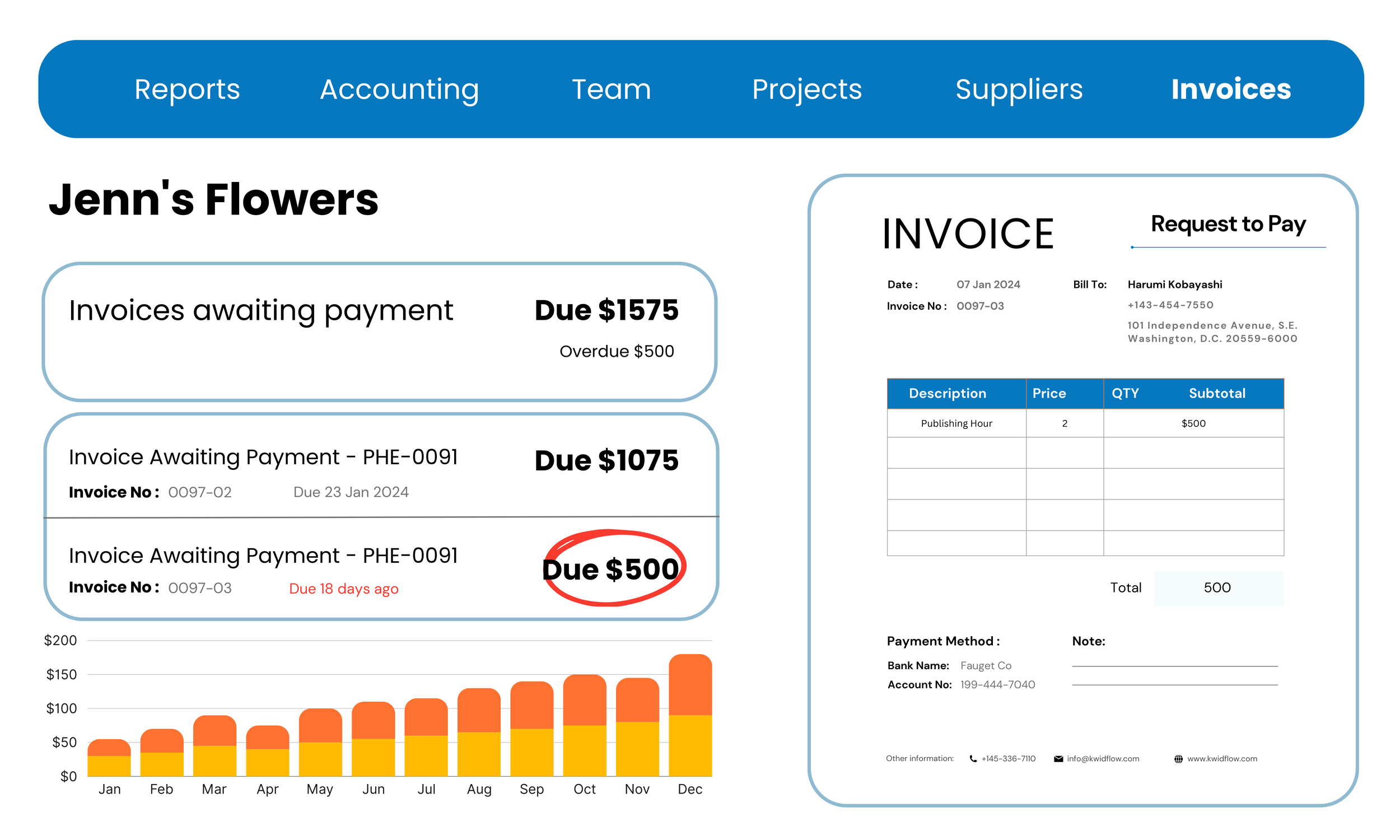

Unlike traditional solutions, our B2B solution rapidly analyses supplier, buyer, and payment data to evaluate risk exposure and target upcoming receivable transactions for advance payment.

kwidflow integrates within an existing ecosystem - for example: accounting software

Data

Invoice and payment data

Supplier credit worthiness

Buyer invoice scheduling and payment processes

AI

Algorithms score Supplier, Buyer, and transaction history

Decision Engine gathers signals from external sources

Machine learning improves pricing and advance decisions over time

Payments

Receivable transactions are prioritized for early payment within seconds of customer request

Pricing varies with risk threshold and payment terms

Business customers can make a request for early payment directly from their bank or invoice systems

We are a data and AI company - not a bank - by partnering with companies that provide banking and accounting solutions kwidflow improves the customer experience while providing much needed liquidity using AI at scale.

Contact Us - info@kwidflow.com

We have deep experience in financial services and a proven track record of building and launching financial products at scale